[Raw Material] The ex-factory quotation for small-sized semi coke was about 900-1050 CNY/T; The factory price of silica was around 180-260 CNY/T; The price of oxide skin was around 960-990 CNY/T; The price of electrode paste was about 4300-5000 The electricity prices ranged from 0.41 to 0.52 CNY//kWh.

[Spot Market] This week, some steel plants announced tender information in June, there would be a new round of release on the demand side; The stable and upward trend in the magnesium metal market provided strong support for the price of 75 # ferrosilicon; Although the futures market has been declining for three consecutive days, the spot market has remained strong. The quotation for 72# ferrosilicon standard blocks risen to around 6900-7200 CNY/T, while the quotation for 75# ferrosilicon standard blocks around 7600-7800 CNY/T. The inventory on the production end mostly remained low, with scheduling production and profit recovery, the manufactures had a good mentality and high production enthusiasm, and the subsequent output would increase. Some market participants were also cautious about the future market situation. Pay attention to changes in supply and demand relationships and the trend of steel recruitment in June.

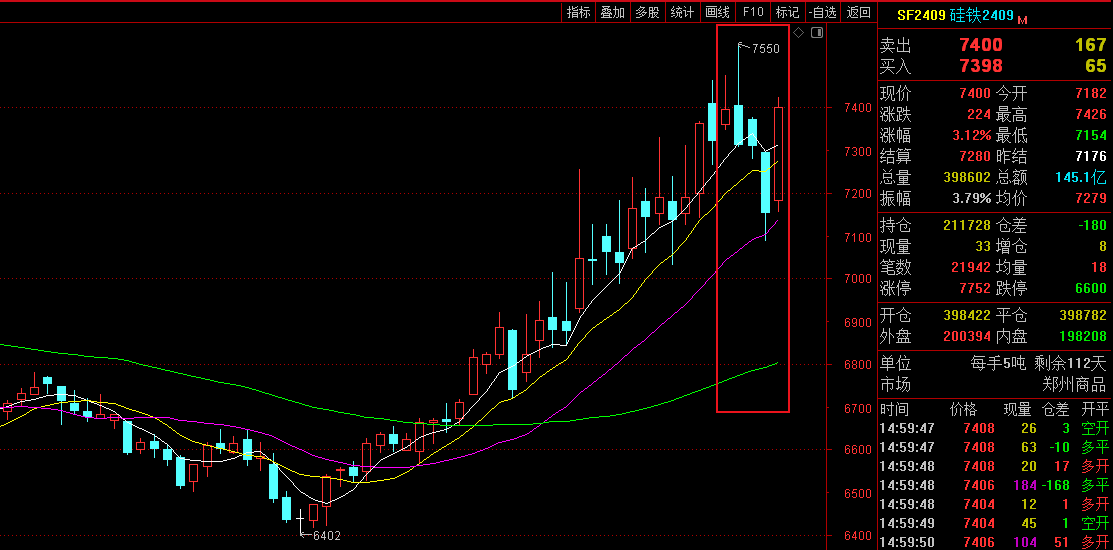

[Futures Market] The opening price of 2409 main contract was 7360 CNY/T, the highest price was 7550 CNY/T, the lowest price was 7088 CNY/T, the closing price was 7400 CNY/T, the settlement price was 7280 CNY/T, the position was 211728 lots, the trading volume was 1760918 lots, and the transaction amount was 64.4504 billion yuan, an increase of 0.60%.

Below are the Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

5.20 |

7360 |

7478 |

7346 |

7396 |

7400 |

0.54% |

329821 |

239439 |

1220191.8 |

|

5.21 |

7404 |

7550 |

7308 |

7312 |

7424 |

-1.19% |

409762 |

226348 |

1520854.22 |

|

5.22 |

7372 |

7376 |

7240 |

7306 |

7310 |

-1.54% |

283848 |

223752 |

1037354.6 |

|

5.23 |

7296 |

7296 |

7088 |

7152 |

7176 |

-2.16% |

338885 |

211908 |

1215968.26 |

|

5.24 |

7182 |

7426 |

7154 |

7400 |

7280 |

3.12% |

398602 |

211728 |

1450668.04 |

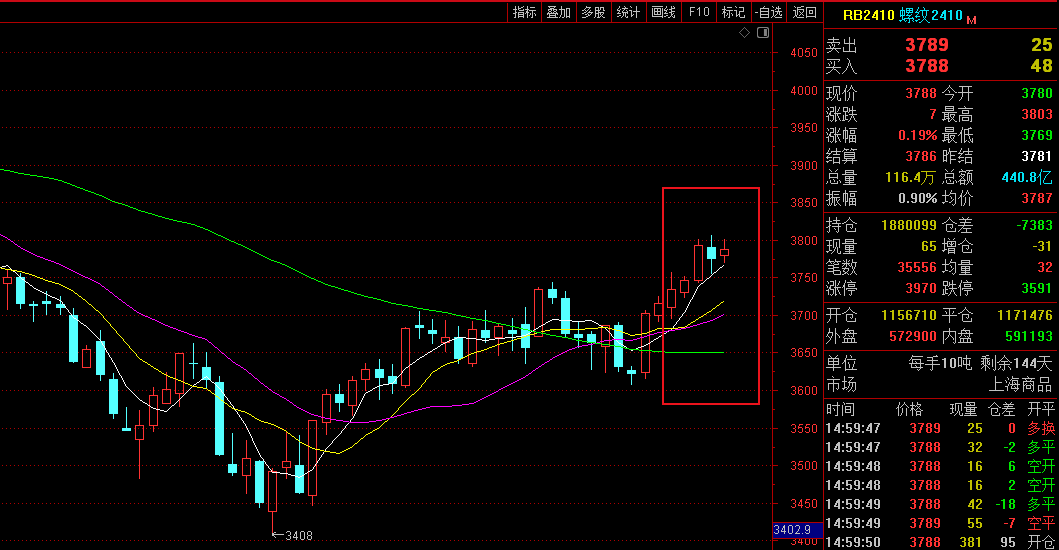

[Demand Market] According to statistics from CISA, in mid May 2024, a total of 22.0922 million tons of crude steel were produced by key steel enterprises, with a daily crude steel production of 2.2092 million tons, an increase of 0.81% compared to the previous month; At the end of mid May, the statistics showed that the steel inventory of key steel enterprises was about 16.8264 million tons, an increase of 547000 tons or 3.36% compared to the previous ten days (i.e. early May); Compared to the same period last month, it decreased by 1.2897 million tons, a decrease of 7.12%. Under the positive influence of macroeconomic policies, steel mills slightly increased production. It was predicted that the decline in demand for steel on real estate side in the future was expected to continue to narrow, and there was a strong expectation of improvement in demand for steel in infrastructure. In the short term, steel prices may continue to fluctuate.

In the early part of this week, driven by the continuous upward trend of ferrosilicon and coal prices, the magnesium market has rebounded. However, in the later stage, due to insufficient demand follow-up, difficulties in accepting downstream high prices, and lack of strong support, it has slightly declined under pressure. In the short term, the cost side supports the strong willingness of factories to raise prices, while downstream demand has not shown significant improvement, there is limited room for magnesium prices to rise, and it may mostly operate with narrow fluctuations. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was still around 18500-18600 CNY/T.Follow up on demand and transaction status.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think