[Raw Material] The ex-factory quotation for small-sized semi coke was about 890-990 CNY/T; The factory price of silica was around 180-260 CNY/T; The price of oxide skin was around 960-990 CNY/T; The price of electrode paste was about 4300-5000 The electricity prices ranged from 0.41 to 0.52 CNY//kWh.

[Spot Market] This week, HBIS Group finally priced its 75B ferrosilicon tender, with a month-on-month increase of 700 CNY/T to 7300 CNY/T, and the volume was 1516 tons. The futures market continued to rise, as well as steel mills tender leading to a concentrated release of demand, the tight spot situation has not changed, and manufacturers were enthusiastic on producing and the quotation continued to operate steadily and strongly. The quotation for 72# ferrosilicon standard blocks risen to around 6850-7000 CNY/T, while the quotation for 75# ferrosilicon standard blocks around 7250-7450 CNY/T, it’s difficult to find low-priced sources. Some industry insiders believed that if the supply and demand relationship continues to improve, there is further upward space for the ferrosilicon market.

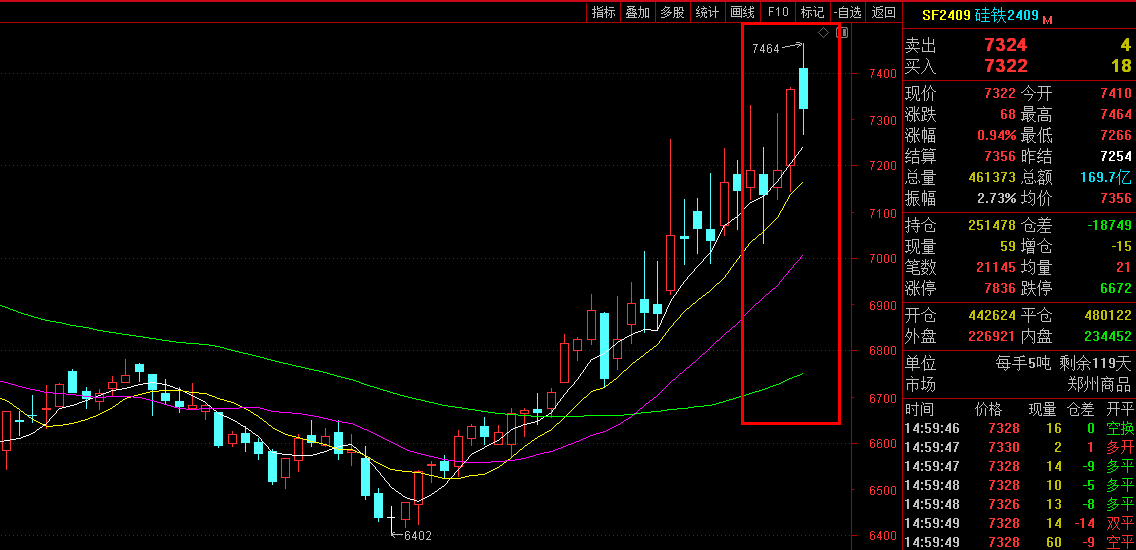

[Futures Market] The opening price of 2409 main contract was 7152 CNY/T, the highest price was 7464 CNY/T, the lowest price was 7030 CNY/T, the closing price was 7322 CNY/T, the settlement price was 7356 CNY/T, the position was 251478 lots, the trading volume was 2474122 lots, and the transaction amount was 89.4765 billion yuan, an increase of 2.72%.

Below are the Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

5.13 |

7152 |

7332 |

7124 |

7190 |

7210 |

0.87% |

553390 |

255133 |

1994556.76 |

|

5.14 |

7180 |

7240 |

7030 |

7136 |

7152 |

-1.03% |

435265 |

227142 |

1556589.39 |

|

5.15 |

7152 |

7314 |

7124 |

7190 |

7204 |

0.53% |

575287 |

234966 |

2071840.15 |

|

5.16 |

7200 |

7370 |

7142 |

7364 |

7254 |

2.22% |

448807 |

270227 |

1627726.59 |

|

5.17 |

7410 |

7464 |

7266 |

7322 |

7356 |

1.34% |

461373 |

251478 |

1696941.15 |

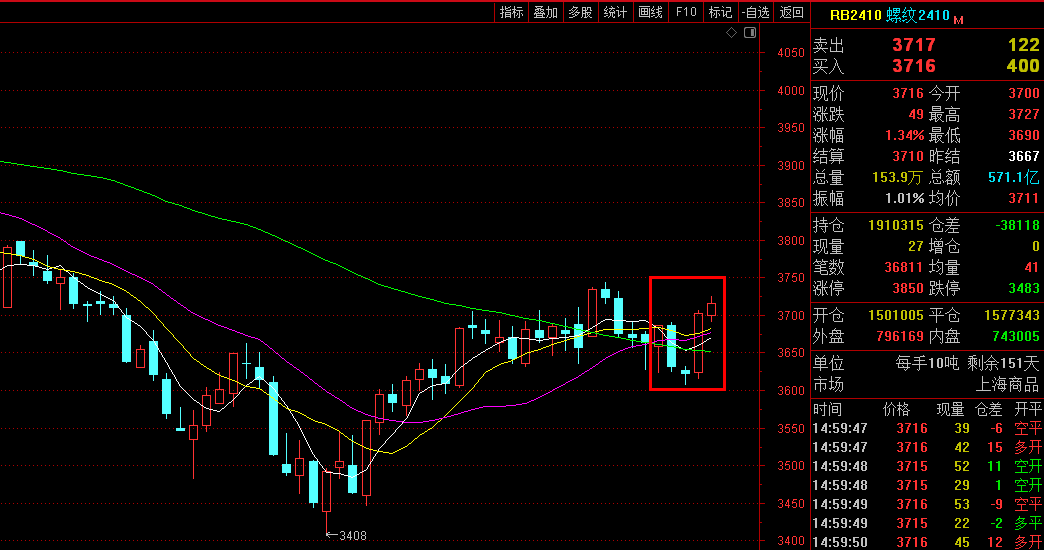

[Demand Market] According to data from the National Bureau of Statistics, in April 2024, China's crude steel production reached 85.94 million tons, a year-on-year decrease of 7.2%; From January to April, China's crude steel production reached 34.367 million tons, a year-on-year decrease of 3.0%. According to data from China Iron & Steel Association, in early May 2024, the daily crude steel production of key steel enterprises was 2.1915 million tons, a decrease of 0.36% compared to the previous period; The social inventory of 5 major varieties of steel in 21 cities was 11.55 million tons, a decrease of 440000 tons compared to the previous month, a decrease of 3.7%. Inventory continued to decline, and the situation was better than market expectations. The futures market fluctuated upwards, driving the spot price to generally rise, giving the market some confidence. The economic situation continues to rebound, and short-term steel prices may continue to fluctuate and operate strongly.

This week, the domestic magnesium metal market remained stable, with a strong sense of game between supply and demand. Manufacturers had a strong willingness to raise prices, while the demand side mainly focuses on "only buying on low prices", operated cautiously. After several twists and turns, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area on Friday was still around 18300-18400 CNY/T. Follow up on demand and transaction status.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think