[Raw Material] The ex-factory quotation for small-sized semi coke was about 860-950 CNY/T; The factory price of silica was around 180-260 CNY/T; The price of oxide skin was around 960-990 CNY/T; The price of electrode paste was about 4300-5000 The electricity prices ranged from 0.36 to 0.48 CNY//kWh.

[Spot Market] Under the traditional off-season, the ferrosilicon market continued to operate weakly, with a strong wait-and-see sentiment and cautious procurement operations. HBIS Group tendered 2629 tons of 75B ferrosilicon in July, an increase of 429 tons compared to the previous month; the tender price was 7050 CNY/T, a decrease of 500 CNY/T month on month, which dampened market confidence. It was understood that the electricity prices in some major production areas have been lowered, the cost side support has weakened, and the futures market has been declining all the way (with a brief technical rebound on Thursday, but another downward trend on Friday). Multiple negative factors have affected the market, with the quotation for 72# ferrosilicon standard blocks mostly around 6600-6700 CNY/T, and the quotation for 75# ferrosilicon standard blocks mostly around 7100-7200 CNY/T. Beware of the risk of accumulating inventory.

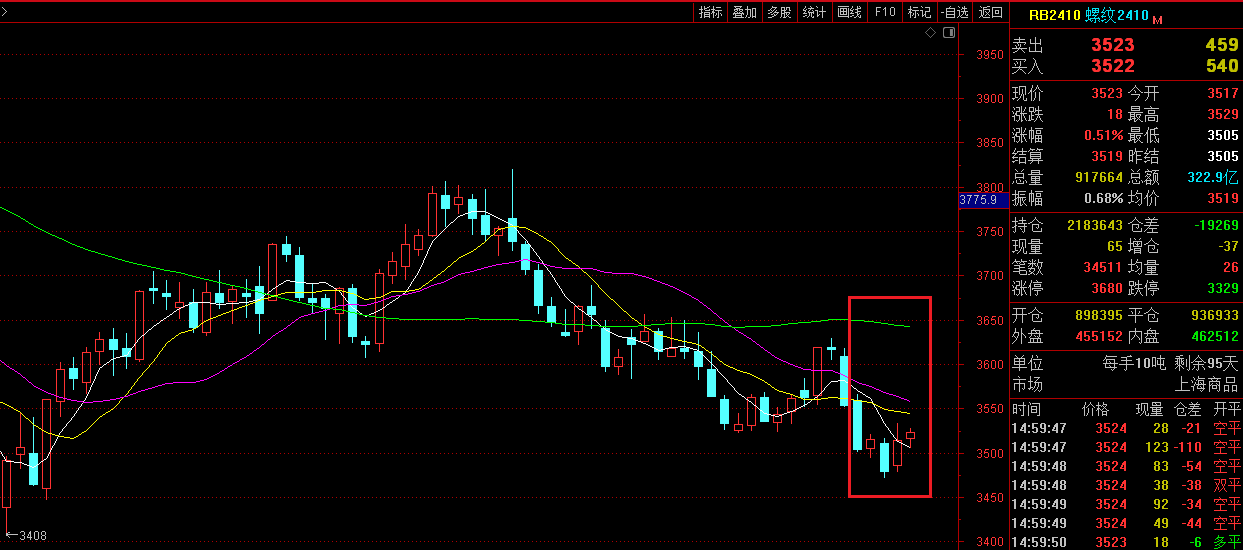

[Futures Market] The opening price of 2409 main contract was 6894 CNY/T, the highest price was 6974 CNY/T, the lowest price was 6652 CNY/T, the closing price was 6682 CNY/T, the settlement price was 6726 CNY/T, the position was 153777 lots, the trading volume was 451106 lots, and the transaction amount was 15.2581 billion yuan, a decrease of 3.47%.

Below are the Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

7.8 |

6894 |

6974 |

6802 |

6818 |

6870 |

-1.50% |

110908 |

147356 |

380991.61 |

|

7.9 |

6824 |

6866 |

6708 |

6740 |

6760 |

-1.89% |

123392 |

161722 |

417278.17 |

|

7.10 |

6706 |

6756 |

6652 |

6672 |

6696 |

-1.30% |

76007 |

163656 |

254432.59 |

|

7.11 |

6684 |

6768 |

6652 |

6750 |

6716 |

0.81% |

79468 |

153515 |

266857.02 |

|

7.12 |

6750 |

6790 |

6680 |

6682 |

6726 |

-0.51% |

61331 |

153777 |

206253.94 |

[Demand Market] On Thursday and Friday of this week, the futures market rebounded slightly, leading to a gradual increase in price sentiment on the spot side, and mainstream quotes have been raised. However, under the hot and rainy weather, the demand for steel continued to be weak, and many steel mills have begun production reduction and maintenance plans. The steel market was in a weak supply and weak demand situation, and the cost of raw materials has fallen, with support moving downwards. Although there has been a rebound, it was judged to be mainly a technical rebound and has not formed a sustained upward driving force. Steel prices may continue to fluctuate in a narrow range.

This week, the domestic magnesium market was under pressure and weakly running due to an oversupply pattern, with weak demand and light transactions. Some factories have lowered their prices slightly according to the market trend. However, considering that some factories have already incurred losses and have a strong mentality of stabilizing prices, the supply and demand sides would continue to be in the game, it was expected that the magnesium market may maintain weak and stable operation next week. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 17800-17900 CNY/T.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think