Cost Side: The ex-factory quotation for small-sized semi coke was about 950-1050 CNY/T; The factory price of silica was around 200-260 CNY/T; The price of oxide skin was around 990-1020 CNY/T; The price of electrode paste was around 4300-5000 CNY/T; The electricity prices ranged from 0.41 to 0.52 CNY//kWh.

Spot Market: The ferrosilicon market continued to stabilize in May. The futures market slightly consolidated, but overall rose; HBIS Group's tender price for 75B ferrosilicon was 7300 CNY/T, an increase of 700 CNY/T compared to the previous month, with a volume of 1516 tons; Most of the inventory on the production end was low. Manufacturers scheduled production, with profit recovery, good mentality, and increased production enthusiasm. After the May Day holiday, enterprises in major production areas such as Zhongwei in Ningxia, Inner Mongolia, and Shaanxi have resumed production, and daily production has rebounded; The stable and upward trend in the magnesium metal market provided support for the price of 75 # ferrosilicon.

On May 29th, a notice on the issuance of the 2024-2025 Energy Conservation and Carbon Reduction Action Plan was issued. The plan points out that by 2024, energy consumption and carbon dioxide emissions per unit of GDP would be reduced by about 2.5% and 3.9% respectively, while energy consumption per unit of value-added industrial units above designated size will be reduced by about 3.5%. At the same time, it involves "reasonable control of the scale of the semi-coke industry" and "strictly prohibiting the implementation of electricity price discounts for high energy consuming industries". On the morning of May 30th, the main contract of ferrosilicon futures rose the limit up in response, with a highest price of 7824 CNY/T, an increase of 8.01%; On the 31st, the market closed at 8108 CNY/T, up 5.27%; Manufacturers were suspending their quotations. According to the latest information, the quotation for 72# ferrosilicon standard blocks in the main production areas increased to around 7600-7880 CNY/T.

Futures Market: In May, 2024, the monthly opening price of the main contract 2409 was 7046 CNY/T, the highest price was 8234 CNY/T, the lowest price was 6984 CNY/T, the closing price was 8108 CNY/T, the settlement price was 8074 CNY/T, the position was 268574 lots, the trading volume was 10037023 lots, and the transaction amount was 374.4650 billion yuan, an increase of 14.04%.

Export Data: According to data of China Customs, in April 2024, China's exports of ferrosilicon (containing by weight more than 55% of silicon) amounted to 39515.578 tons, an increase of 2232.988 tons or 5.99% compared to the previous month; A year-on-year increase of 3577.338 tons, with a growth rate of 9.95%. In April 2024, China's exports of ferrosilicon (containing by weight ≤ 55% of silicon) reached 2327.181 tons, an increase of 106.581 tons compared to the previous month, or 4.80%; A year-on-year increase of 95.281 tons, with a growth rate of 4.27%. From January to April 2024, China exported 151242.457 tons of ferrosilicon (containing by weight more than 55% of silicon), an increase of 4754.3 tons year-on-year or 3.25%; From January to April 2024, China exported 7867.481 tons of ferrosilicon (containing by weight ≤ 55% of silicon), a year-on-year decrease of 676.349 tons, a decrease of 7.92%.

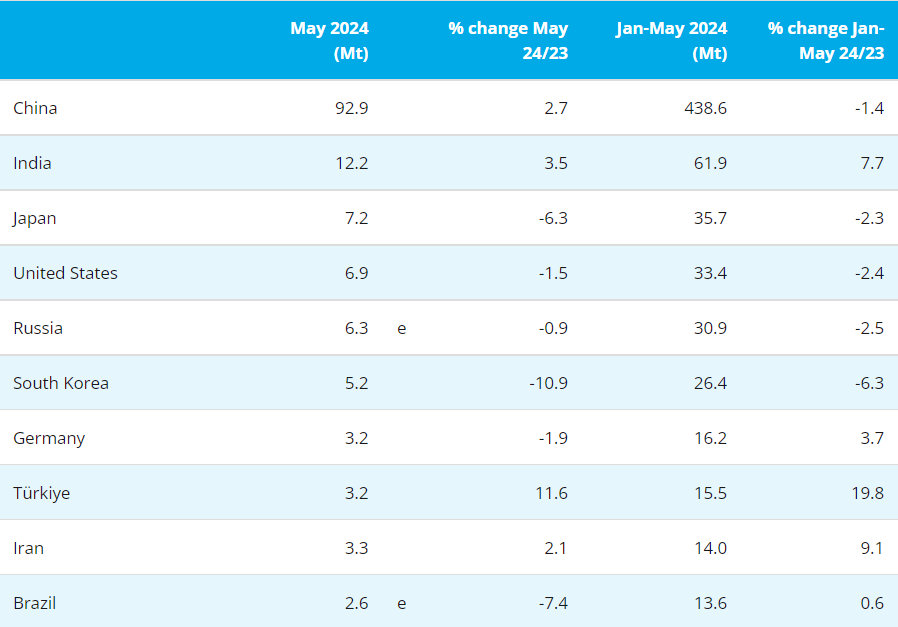

Steel Market: Since May, the prices of raw materials have been relatively strong, and in the middle of the month, stimulated by macroeconomic benefits, the ferrous industries has improved, driving up steel prices. Coupled with the release of downstream procurement demand, the trading volume has stabilized, and a large number of steel mills have resumed production. However, the industry is about to enter the off-season, and the impact of weather factors is increasing. The market continued to decline at the end of May. It is difficult to predict the release of demand in the later period, and there are even expectations of a reduction. Considering favorable policies and relatively strong raw material prices, short-term steel prices still have support and are expected to fluctuate narrowly. Pay attention to the release of downstream demand and the supply situation of steel mills.

Metal Magnesium Market: After the May Day holiday, downstream procurement has followed up in an orderly manner, and transactions were still acceptable. Coupled with the support of raw material costs, the magnesium market has steadily rebounded; However, the manufacturers were willing to raise prices, while the demand side focuses on "buying on low prices" and operates cautiously, with low acceptance of high prices, and the magnesium market maintained stable operation in mid month, which was relatively strong. The "2024-2025 Energy Conservation and Carbon Reduction Action Plan" released at the end of the month has driven up the price of ferrosilicon, resulting in an improvement in transactions in the magnesium market and a rebound in prices. In the short term, it was expected to be mainly strong. But after all, downstream demand has not shown significant improvement, and there was limited room for magnesium prices to rise. At the end of the month, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 18700-18800 CNY/T. Pay attention to the implementation of relevant measures and follow-up demands.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Online inquiry

Online inquiry Contact

Contact

Tell Us What You Think