[Raw Material] The ex-factory quotation for small-sized semi coke was about 1000-1050 CNY/T; The factory price of silica was around 200-250 CNY/T; The price of oxide skin was around 1010-1040 CNY/T; The electricity prices ranged from 0.38 to 0.50 CNY//kWh.

[Spot Market] During the traditional off-season, the demand has further weakened. In Jan-Feb 2024, HBIS Group tendered 2656 tons of ferrosilicon 75B at a price of 7020 CNY/T, a decrease of 80 CNY/T from December. The follow-up demand of the metal magnesium market was short, and the overall situation was weak; Under the dominance of bearish factors, the ferrosilicon futures market experienced a weak and volatile downward trend, and the spot market was operating under pressure. Transactions were not smooth, and prices have dropped to the cost line. It was understood that some manufacturers in the main production areas produced avoiding peaks, and the mentality of price support was gradually increasing. However, it was expected that the overall supply reduction would be limited, and the market was mostly in a wait-and-see mood, with cautious operations. The quotation for 72# ferrosilicon standard blocks was mostly around 6550-6650 CNY/T, while the quotation for 75# ferrosilicon standard blocks was around 7100-7200 CNY/T.

[Futures Market] The opening price of 2403 main contract was 6758, the highest price was 6804, the lowest price was 6652, the closing price was 6700, the settlement price was 6714, the position was 265850, the trading volume was 555473, and the transaction amount was 18.6353 billion yuan, a decrease of 0.62%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Range |

Trading volume |

Positions |

Trading value (10000’ tons) |

|

1.8 |

6758 |

6804 |

6708 |

6712 |

6756 |

-0.44% |

120759 |

319334 |

407841.04 |

|

1.9 |

6702 |

6740 |

6664 |

6702 |

6698 |

-0.80% |

119121 |

319175 |

398870.33 |

|

1.10 |

6702 |

6704 |

6652 |

6662 |

6674 |

-0.54% |

109491 |

307677 |

365356.96 |

|

1.11 |

6680 |

6732 |

6678 |

6708 |

6708 |

0.51% |

116477 |

284742 |

390578.45 |

|

1.12 |

6688 |

6744 |

6680 |

6700 |

6714 |

-0.12% |

89625 |

265850 |

300886.05 |

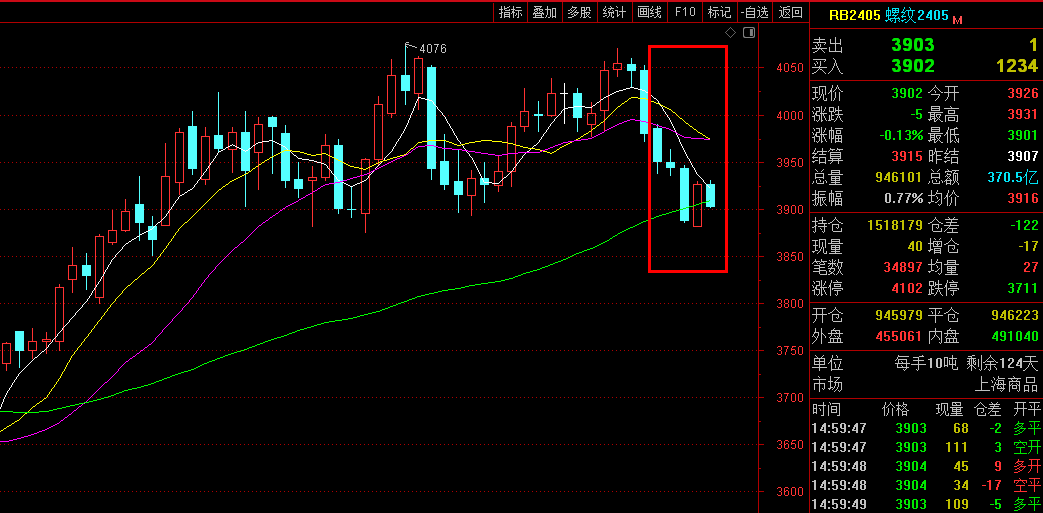

[Demand Market] This week, the futures market for rebar declined, with weak operations on the cost side such as iron ore and coke, driving spot prices to fall and weak transactions. In the traditional off-season, terminal demand was expected to further show weakness, and there was little room for significant price increases in the short term. The market mentality was cautious. In the short term, both supply and demand in the steel market were weak, and prices may continue to fluctuate weakly.

This week, the metal magnesium market continued to operate weakly and steadily, with limited downstream follow-up, with a cautious mindset. The manufacturers have maintained stable production overall, and their profit margins have narrowed or even suffered losses. There was a clear mentality of price support. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 20100-20200 CNY/T.

- [Editor:kangmingfei]

Save

Save Print

Print

Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think