[Raw Material] The ex-factory quotation for small-sized semi coke was around 1180-1250 CNY/T; The factory price of silica was around 200-250 CNY/T; The price of oxide skin was around 980-1010 CNY/T; The price of electrode paste was around 5000 CNY/T; The electricity prices in the main production areas ranged from 0.41 to 0.53 CNY//kWh. Cost side support continued to be strong.

[Spot Market] This week, HBIS Group finalized the tender price for 75B ferrosilicon at 7450 CNY/T, a month on month increase of 120 CNY/T, providing a boost to market confidence. The Qinghai Provincial Development and Reform Commission has issued a notice to hold an expert review meeting on energy consumption levels in the ferroalloy industry, which has adjusted the energy efficiency benchmark level of the ferroalloy smelting industry. It mentioned that 8 ferrosilicon enterprises had not reached the benchmark level, driving a significant increase in the market on Thursday and Friday. At present, the supply side of ferrosilicon remained stable, and with profit recovery, there was room for further increase in production. The steel factory may continue to restock before the National Day holiday, there was a strong sentiment of price support, and the quotes for 72# ferrosilicon standard blocks in the main production areas mostly around 6950-7000 CNY/T, and quotes for 75# ferrosilicon standard blocks around 7300-7400 CNY/T. However, supply and demand determine the market, and it’s still necessary to closely monitor changes in the supply and demand relationship.

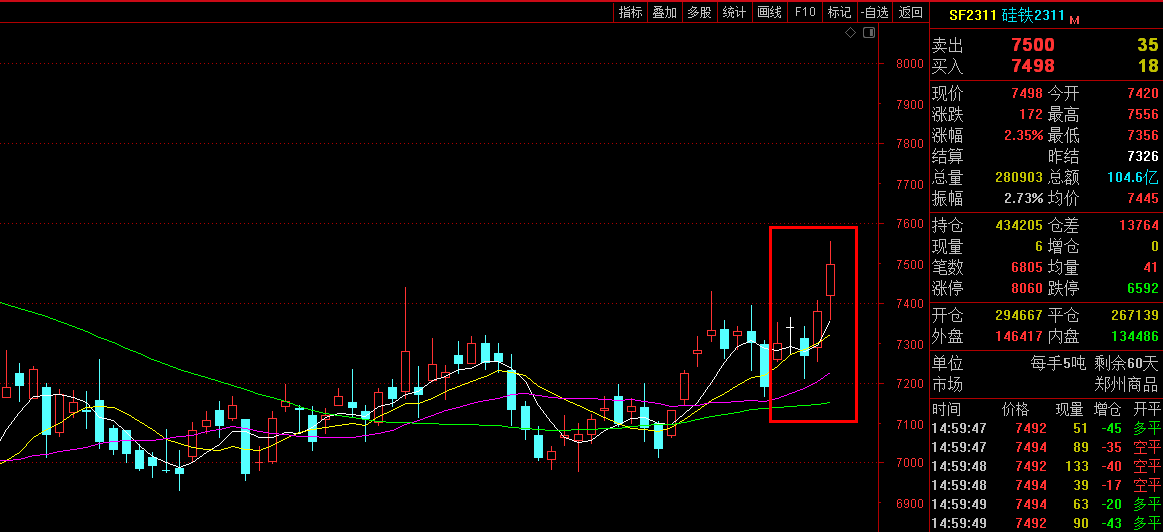

[Futures Market] The weekly opening price of the 2311 main contract was 7258, with a maximum price of 7556, a minimum price of 7210, a closing price of 7498, a settlement price of 7446, a trading volume of 1110735, and a position of 434205, an increase of 4.28%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

9.11 |

7258 |

7354 |

7252 |

7298 |

7314 |

211235 |

424522 |

0.91% |

|

9.12 |

7420 |

7556 |

7356 |

7498 |

7446 |

280903 |

434205 |

0.33% |

|

9.13 |

7312 |

7342 |

7210 |

7264 |

7282 |

218921 |

418126 |

-0.63% |

|

9.14 |

7288 |

7410 |

7252 |

7380 |

7326 |

217727 |

420441 |

1.35% |

|

9.15 |

7420 |

7556 |

7356 |

7498 |

7446 |

280903 |

434205 |

2.35% |

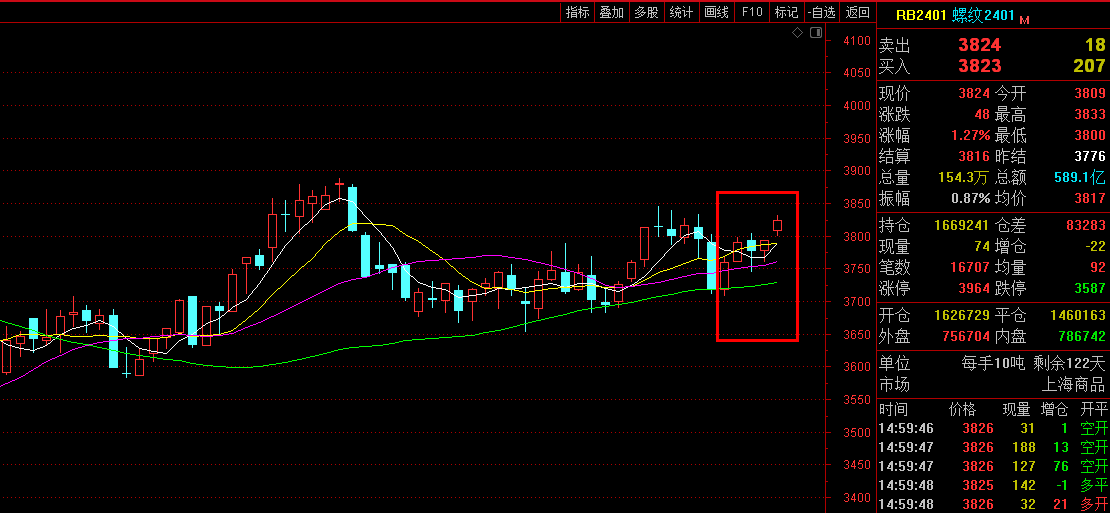

[Demand Market] According to data from CISA, in early September 2023, key steel enterprises produced a total of 21.5879 million tons of crude steel, with a daily output of 2.1588 million tons, a month on month increase of 5.53%. In early September, the inventory in key steel enterprises were 15.8033 million tons, an increase of 1.0788 million tons or 7.33% compared to late August; A decrease of 248400 tons or 1.55% compared to the same period last month; A decrease of 1.2612 million tons or 7.39% compared to the same period last year. In early September, the social inventory of 5 major varieties in 21 cities was 9.57 million tons, a decrease of 50000 tons compared to the previous month, a decrease of 0.5%, and the inventory continued to decline slightly; An increase of 770000 tons or 8.8% compared to the same period last year. The traditional peak season of has arrived, with stable growth on the supply side and slow recovery on the demand side, the rise in steel prices was under pressure, but the support on the raw material side was strong, and the space for steel price reduction was also limited. At present, it may take some time for macroeconomic favorable policies to be implemented, and the market mentality was biased towards caution.

This week, the price of magnesium went down to 24000 CNY/T on Monday, and then stabilized with some customers entering the market to stock up before the National Day holiday. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was mostly around 24500 CNY/T. The current factory inventory was being released in an orderly manner, with little pressure and a strong attitude towards price increasing; On the demand side, due to the National Day holiday approaching, downstream stocking gradually increased, and the market was mostly optimistic about the short-term market. Follow up on downstream demand.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think