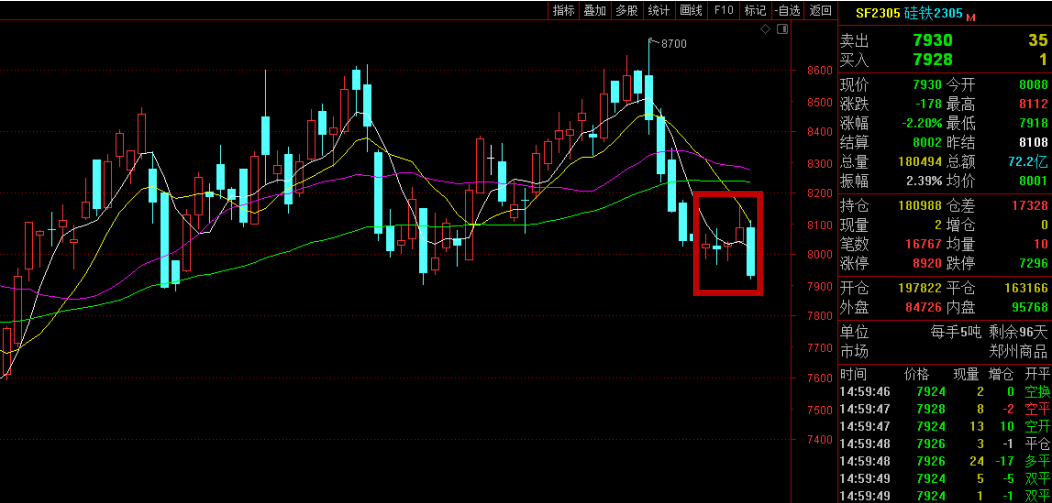

This week, Ferrosilicon Futures fluctuated and consolidated. The opening price of 2305 main contract was 8022, the highest price was 8166, the lowest price was 7918, the closing price was 7930, the settlement price was 8002, the trading volume was 816250, and the position was 180988, a decrease of 0.80%. Under the condition of high operating rate and weak demand, market sentiment was cautious. The price of the cost end of the semi-coke remained stable, and the electricity charges in Ningxia, Qinghai, Gansu, Shaanxi and other places increased slightly by 0.02-0.05 yuan per kilowatt hour, affecting the production cost of ferrosilicon by about 160 CNY/T, and the manufacturer's willingness to deal at a low price was not strong. The speed of de-stocking at the demand side was slightly slow. The published steel tender price in February is mostly around 8400-8500 CNY/T, with a month-on-month decrease of about 200 CNY/T. The spot transaction was not that good, the quotation changed little, and the operation was weak and stable.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

2.6 |

8022 |

8070 |

7984 |

8034 |

8028 |

143241 |

145315 |

0.50% |

|

2.7 |

8026 |

8084 |

7964 |

8016 |

8026 |

163505 |

155438 |

-0.15% |

|

2.8 |

8026 |

8046 |

7978 |

8036 |

8010 |

151736 |

164505 |

0.12% |

|

2.9 |

8042 |

8166 |

8034 |

8086 |

8108 |

177274 |

163660 |

0.95% |

|

2.10 |

8088 |

8112 |

7918 |

7930 |

8002 |

180494 |

180988 |

-2.20% |

As for the steel market, with the gradual resumption of downstream projects, the steel turnover has improved, which has brought some confidence to the market, but the stock pressure was still large and the speed of decreasing inventory was slow. It was reported that most steel mills were still at the edge of loss, and there was an expectation of a rebound in downstream demand, and steel mills had a low willingness to deal at low prices. In 2023, with the gradual release of the effect of economic stabilization policies, the demand for steel was expected to recover; The industry was also optimistic about China's economic development in 2023, and believed that market demand would increase after a period of stable transition. But at present, the recovery of demand was insufficient, and there was still caution in the optimistic mood.

In terms of metal magnesium, after the resumption of the Spring Festival, the domestic magnesium market has maintained a stable operation for around ten days. Due to the weak downstream demand, the quotation has been slightly reduced on Wednesday, and the transaction was normal, and the export situation was poor. However, considering the cost support and the expected recovery of demand, the price of magnesium would not fall too much. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 21800-22000 CNY/T.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think