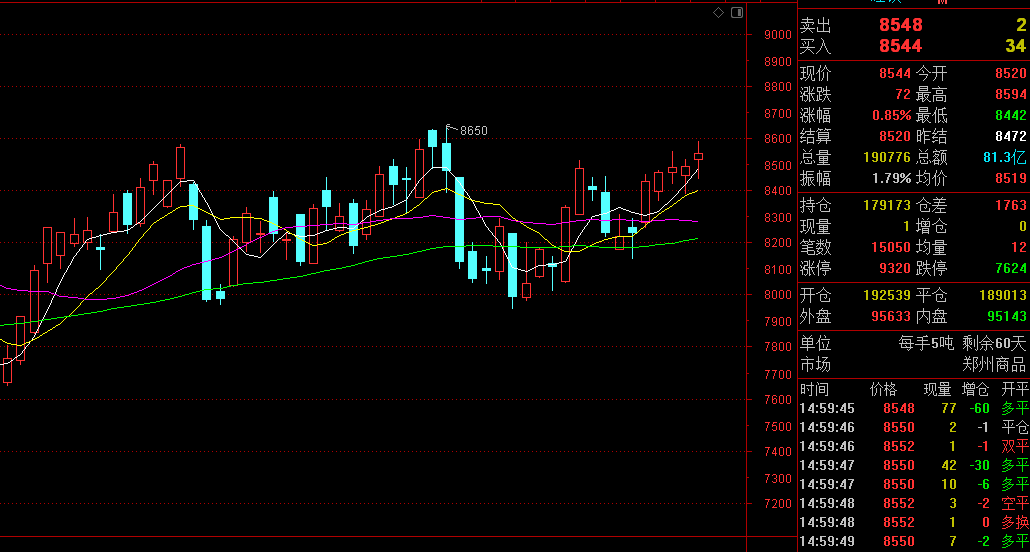

This week, Ferrosilicon Futures stopped falling and rebounded all the way up, with a strong trend. The opening price of the 2303 main contract was 8278, the highest price was 8594, the lowest price was 8254, the closing price was 8544, the settlement price was 8520, the trading volume was 839924, and the position was 839924, up 3.94%. The spot end still maintained a stable trend, most manufacturers produced normally, and the order has been arranged until next month, and the inventory was tight; As the Spring Festival approached, the market transaction atmosphere weakened and the actual demand was weak, but the possibility of a sharp decline in demand in the short term was also small. There was no fluctuation in the spot price of ferrosilicon, the price of 72# ferrosilicon was about 8200-8300 CNY/T, and that of 75# ferrosilicon was about 8600-8700 CNY/T. Pay attention to the performance of both supply and demand sides and the trend of futures market.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

1.9 |

8278 |

8464 |

8254 |

8436 |

8392 |

181919 |

176340 |

2.63% |

|

1.10 |

8396 |

8480 |

8360 |

8468 |

8428 |

136459 |

178712 |

0.91% |

|

1.11 |

8468 |

8556 |

8422 |

8490 |

8510 |

166299 |

187706 |

0.74% |

|

1.12 |

8460 |

8524 |

8384 |

8492 |

8472 |

164471 |

177410 |

-0.21% |

|

1.13 |

8520 |

8594 |

8442 |

8544 |

8520 |

190776 |

179173 |

0.85% |

Downstream, according to the data of the CISA, in late December 2022, the daily output of crude steel of key steel enterprises was 1.9159 million tons, down 2.44% month-on-month. In late December, the steel inventory of key steel enterprises was 13.0566 million tons, a decrease of 2.9335 million tons and 18.35% compared with the previous ten days; 2.2473 million tons or 14.68% lower than the end of last month (i.e. the same day of last month); Compared with the end of last year (the same period of last year), it increased by 1.7597 million tons or 15.5%. In addition, according to the prediction of the CISA, China's crude steel output in 2022 would be about 1.01 billion tons, a year-on-year decrease of 23 million tons, or 2.2%. As the Spring Festival approached, the steel production continued to decline, and the manufacturers still had bullish expectations for the market after the holiday. However, due to the weak demand, and the light transaction before the Spring Festival , the market was expected to be in a stable operation in the short term.

In terms of metal magnesium, in the early part of this week, the transaction was generally good, and the magnesium market rose up moderately; The transaction weakened in the later period, and the magnesium price slightly declined. With the Spring Festival approaching, the holiday atmosphere was increasingly strong, and the market activity was weakening. The factory mainly focused on delivering orders, and the delivery pressure was not large. It was not expected that there would be too much fluctuation before the holiday, and it would mostly end with a stable trend. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 21800-21900 CNY/T.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think