The ferrosilicon market, which has been depressed for many days, finally ushered in good news and market confidence has been boosted. This week, the ferrosilicon futures has been shaken and consolidated, with a slight recovery. The start-up of manufacturers was relatively stable, and some quotations have increased slightly. Although the transaction performance has not improved significantly, the downstream procurement was cautious, the market sentiment was still relatively wavering, and the wait-and-see mood was strong, but with the support of costs such as semi-coke and electricity, there was limited room for the decline of ferrosilicon price. In the short term, the overall fluctuation of the market should not be too large. Pay attention to the trend of futures and the performance of steel tender.

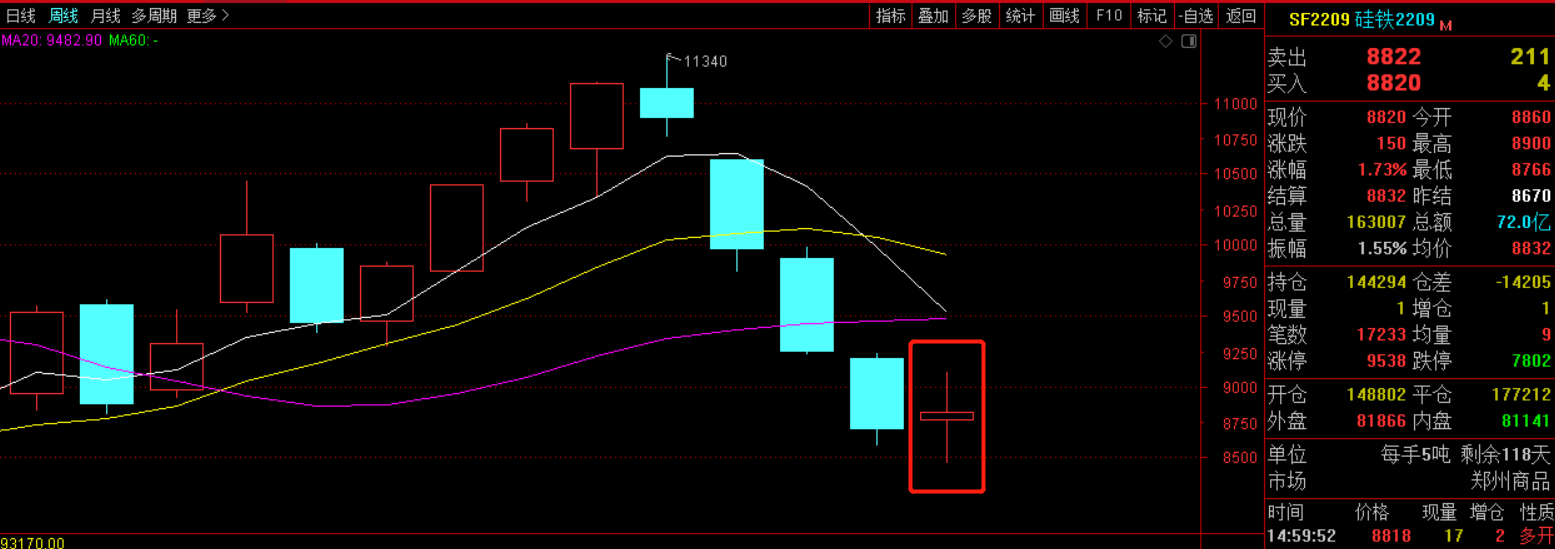

The weekly opening price of 2209 main contract was 8,772, the highest price was 9,112, the lowest price was 8,462, the closing price was 8,820, the settlement price was 8,832, the trading volume was 922,099, and the position was 144,294, up 0.64%.

Below are ferrosilicon futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

5.16 |

8772 |

8866 |

8740 |

8842 |

8806 |

181005 |

151041 |

0.89% |

|

5.17 |

8898 |

9112 |

8858 |

8962 |

8988 |

215027 |

149569 |

1.77% |

|

5.18 |

8922 |

8922 |

8682 |

8698 |

8792 |

175855 |

154782 |

-3.23% |

|

5.19 |

8530 |

8794 |

8462 |

8776 |

8670 |

187205 |

158499 |

-0.18% |

|

5.20 |

8860 |

8900 |

8766 |

8820 |

8832 |

163007 |

144294 |

1.73% |

In terms of downstream steel mills, the current supply side 2qs still low year-on-year. Luo Tiejun, vice president of China Iron and Steel Industry Association, said recently that China's crude steel output would continue to decrease (from January to April 2022, the crude steel output of 13 provinces/cities decreased by more than 10% year-on-year, including 17.04% in Hebei, 21.88% in Shandong, 12.28% in Henan and 20.59% in Fujian). In April, the steel market demand was still less than expected; Domestic steel production increased month on month and continued to decline year on year; Since May, steel prices have shown a slight downward trend (CISA). However, the analysis showed that the steady growth policy was still expected to drive the recovery of industry demand. With the gradual improvement of the prevention and control situation, crude steel consumption was expected to rise moderately with the economy, and the supply and demand would continue to improve. At present, the actual steel demand was still weak, the steel price was still in the shock, and the market confidence was still insufficient, but there was no need to be overly pessimistic. Once the demand is recovered, the steel price is still likely to rebound.

This week, the domestic metal magnesium market lack of good news, the market confidence was weak, the downstream demand continued to be weak, the acceptance of high prices was difficult, and the market fluctuated downward. With the decline of magnesium price, the trading volume improved, and the willingness of factories to continue to make price concessions weakened. Under the game between supply and demand, the magnesium market may still be in a weak consolidation state in the short term. The ex-factory cash quotation including tax of 99.9% magnesium ingots on Friday was about 32500-33000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think