At present, the market lacks positive factors and the futures continued to decline, as well the spot price continued to decline. It was known that the tender price of ferrosilicon of a steel plant in Hunan has shrunk to 9100 yuan per ton. The confidence of the supply side was poor, and some manufacturers did not offer for the time being. Under the influence of the wait-and-see mood, the transaction especially at high prices was difficult. There were few downstream orders and under the condition of continuous stability at the production end, some manufacturers expected that the inventory may be accumulated in the near future. Pay attention to the futures trend and the change of supply-demand relationship.

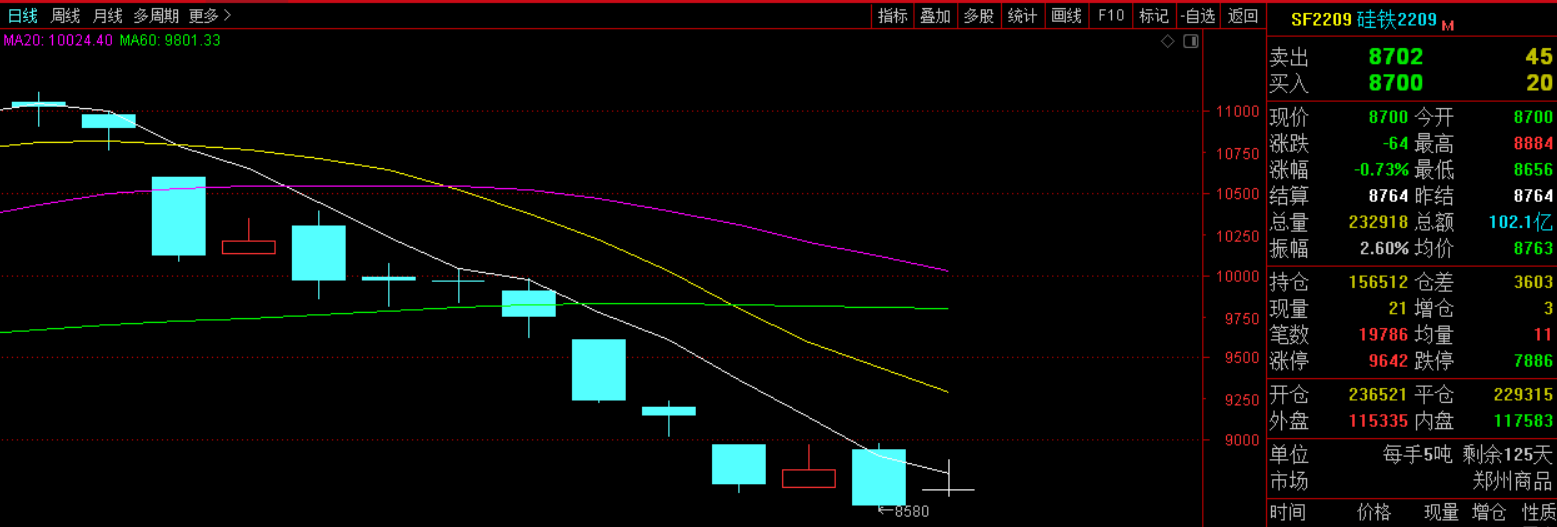

The weekly opening price of 2209 main contract was 9200, the highest price was 9238, the lowest price was 8580, the closing price was 8700, the settlement price was 8764, the trading volume was 1057620, and the position was 156512, down 8.03%.

Below are ferrosilicon futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

5.9 |

9200 |

9238 |

9018 |

9144 |

9126 |

206102 |

138883 |

-3.34% |

|

5.10 |

8970 |

8970 |

8680 |

8730 |

8814 |

226033 |

140601 |

-4.34% |

|

5.11 |

8712 |

8980 |

8710 |

8820 |

8858 |

176326 |

142035 |

0.07% |

|

5.12 |

8940 |

8982 |

8580 |

8604 |

8764 |

216241 |

152909 |

-2.87% |

|

5.13 |

8700 |

8884 |

8656 |

8700 |

8764 |

232918 |

156512 |

-0.73% |

In terms of downstream, according to data of CISA, in the first ten days of May 2022, the key statistics iron and steel enterprises produced a total of 23.0525 million tons of crude steel, with a daily output of 2.3053 million tons of crude steel, a month on month decrease of 2.26%. At the end of early-May, the steel inventory was 18.7485 million tons, an increase of 659800 tons or 3.65% over the previous ten days; An increase of 260400 tons over the same period last month, an increase of 1.41%; An increase of 7.4516 million tons over the beginning of the year, an increase of 65.96%; An increase of 4.0685 million tons over the same period last year, an increase of 27.71%; Compared with the highest point of last year (17.8839 million tons in early March), it increased by 864600 tons, an increase of 4.83%. According to statistics, this week's steel consumption improved month on month, but the overall demand performance was still not optimistic. The inventory level of steel mills was still high, and the short-term steel price was expected to be weak and volatile.

This week, the domestic metal magnesium market was first restrained and then increased. In the early part of the week, the price fell to 33000 yuan per ton. In the late part of the week, the magnesium market began to stop falling and rebound, boosted by the news of the relevant meeting of the semi-coke industry held in Shaanxi region from May 11 to 12. However, at present, the semi-coke rectification plan was still in suspense, and both the supply and demand sides were still more cautious. Generally speaking, the current market was oversupplied; However, considering the uncertainty of environmental protection policies, factories had a strong willingness to stick to high prices, and it was difficult for magnesium prices to go up or down. The ex-factory cash quotation including tax of 99.9% magnesium ingots was about 36000-37000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think