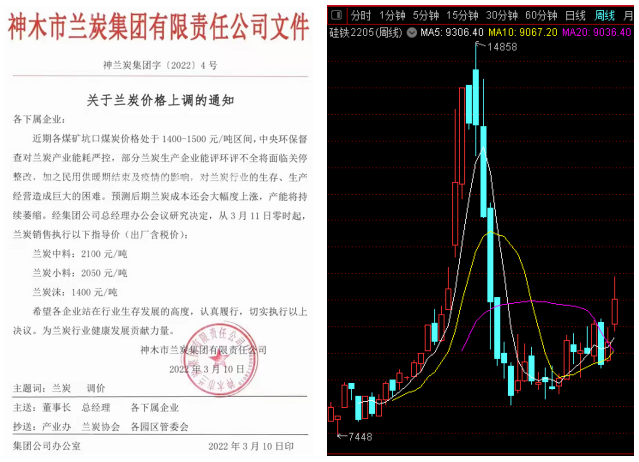

On March 10, Shenmu Semi-coke group issued a notice of price increase: from 0:00 on March 11, the ex-factory tax price of small-sized materials is 2050 yuan per ton and medium materials is 2100 yuan per ton.

Ferrosilicon futures showed strong performance this week, with a sharp rise of 7.65% on Monday and the highest price breaking 10000 yuan per ton! It continued to climb 3.97% on Tuesday, closing at 10060; Consolidation fell on Wednesday and Thursday; and rose again on Friday. This week, the opening price of 2205 main contract was 9550, the highest price was 10450, the lowest price was 9410, the closing price was 10016, the settlement price was 9968, the trading volume was 1863736, and the position was 131094, an increase of 9.08%.

With the strong futures market and cost support of Futures (influenced by the rise of oil and gas prices and the rebound of the epidemic, local freight rates have also increased). At the same time, domestic downstream demand has recovered and overseas demand has increased. At present, the inventory pressure of manufacturers was small. All kinds of positive factors have strongly boosted the spot market. The quotation of ferrosilicon has increased significantly this week, and many manufacturers did not offer for the time being.

In terms of steel, driven by the impact of the international environment and better demand, the current steel market rose synchronously at the beginning of this week. However, due to the sluggish transaction, the steel price soon corrected, rising first and then restraining. In March, although some steel mills arranged routine maintenance, the recovery rhythm of the demand side was accelerated, the profit of the steel mill was ok, and the pressure on the supply side and inventory would not be too great. The industry was cautious and optimistic about the market in March.

This week's domestic magnesium market has a similar trajectory to the steel market: it stabilized and rebounded in the early part of the week, and the acceptance of downstream high prices was low in the later part of the week. The procurement slowed down and the quotation was lowered. Without the support of strong demand, the magnesium market was difficult to change its weakness in the short term. On Friday, March 4, the ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was about 41000-42000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think