[Spot Market] This week, the domestic ferrosilicon market ran stably and well. The futures market overall increased, downstream inquiries increased, transactions were getting more active, and factory quotations continued to rise slightly. According to Ferro-Alloys.com, 72# natural block quotation was around 6700-6750 yuan per ton in Ningxia and about 6800 yuan per ton in Gansu. In March, China's ferrosilicon (containing by weight more than 55% of silicon) export volume increased by 190.43% on a month-on-year basis, which also brought more confidence to the market. Pay attention to the new round of steel bidding information (the price of steel bidding in May was expected to rise from the approximate rate in April) and the policy progress in main production area.

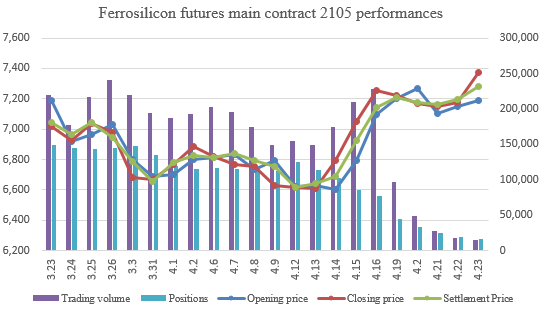

[Ferrosilicon Futures 2105 Contract] Opening price of ferrosilicon futures 2105 contract of this week was 7,200, highest price was 7,398, lowest price was 7,060, closing price was 7,372 and the settlement price was 7,280. The trading volumes were 207,679 and the positions were 16,086.

[Steel Market] Tangshan and Handan strictly implemented in environmental protection and production restriction, and steel futures market ran strongly again, driving spot price rebound; although the domestic and global crude steel production has increased recently (Statistics of CISA: in mid April 2021, the average daily output of crude steel of key steel enterprises was 2.3242 million tons, which has reached a new high record; World crude steel production for the 64 countries reporting to the World Steel Association (worldsteel) was 169.2 million tonnes (Mt) in March 2021, a 15.2% increase compared to March 2020. However, with the gradual recovery of macro-economy, demand expectations are still strong, inventory is still in the downward channel, as well as the price of raw materials rising, have formed a certain support for the steel price.

[Magnesium Market] Supported by the lack of factory spot, sustained release of demand and raw material costs, magnesium prices rose sharply this week, and was expected to be easy to rise but difficult to fall in the short term. However, some factories have indicated that it may take time for the downstream to accept the high price, and the rising trend may be eased later. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 17000 yuan per ton.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think