[Ferro-Alloys.com] It shows increasing trend during April to June and expands its market share =

Judging from the analysis on the import and export statistics in the respective countries, the total distributed volume of cheap ferro-silicon of Chinese origin which did not go through official export procedures in the Asian ferroalloy markets (roundabout products) in the first half (January - June) of 2014 was up from both first half and second half of 2014.

In the first half of 2015, among ferro-silicon (Si > 55%) imported by the respective countries of Japan, South Korea and Taiwan, the ratio of roundabout products decreased in Taiwan, but continues to increase in South Korea and Japan.

Besides, the products imported from Malaysia are increasing steadily in Japan and Taiwan, and the clear change in the distribution map may be confirmed in the end of the year. The situation with regard to roundabout products and Malaysian product are as follows.

[Japan]

The share of roundabout products in the market partly depends on the increase and decrease in the roundabout product volume imported via a third country like Vietnam, and in the periods from January to June last year and from January to March this year when the relationship between China and Vietnam became aggravated, the share of roundabout products was grossly down. However, the imported volume via Vietnam is making a recovery gradually after the period from April to June this year. No import duty is levied on ferro-silicon, which is thought to be advantageous to the increase in the import of roundabout products, and some of the market participants forecast the time is not far off when the roundabout products gains the share reaching the half of the total import volume.

There is a background of the import of Malaysian products being easy because two Japanese firms have interests related to OM Sarawak which is now exporting. However, it seems to become a brake that the production volume of products with Si being 75% as a main item consumed in the domestic market is small and there are many customers which are strict about the size.

During last year, albeit there was a period when the roundabout products decreased temporarily, the roundabout products have continued to increase. Predominantly major steel mills have active purchasing motivation for cheap roundabout products, but the purchasing quantity has yet to increase due to the quantity irregularly shipped from China being less than expected. This is also because of decreased production of product with Si being 75% in China.

The reason why Malaysian ferro-silicon has yet to be imported is because such thing is provided as reasons as the distribution price in South Korea is cheap due to being affected by the roundabout products and there is no merit to sell to South Korea in addition to Malaysia having no extra production volume of product with Si being 75%.

[Taiwan]

The reason why the ratio of roundabout products has decreased since the period from April to June last year is because major blast furnace mills expressed their intention to buy only regularly exported ferro-silicon by emphasizing compliance behavior. That influence still continues and the ratio of roundabout products remains at less than 70% of the total import volume.

Malaysian ferro-silicon is gradually increasing its share. This is because ferro-silicon used in Taiwan is mainly products with Si being 72% which is the same as Malaysian main product. However, the shares of Chinese and Russian products begin to be down with its rebound and are anticipated to be further down in the future.

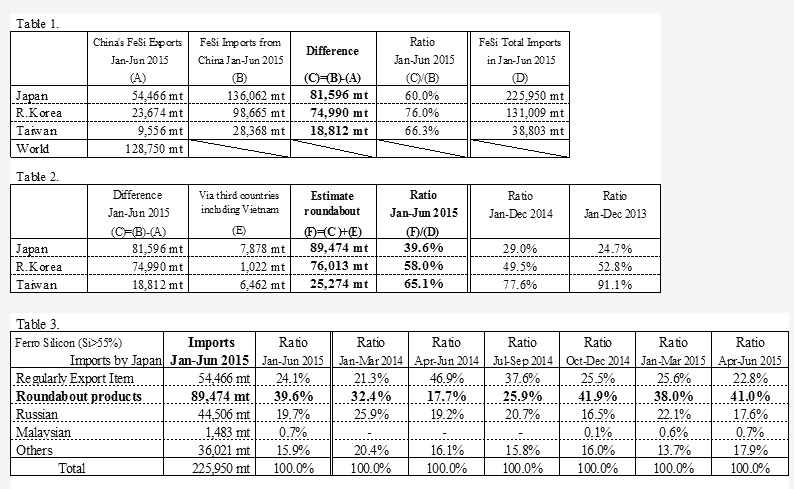

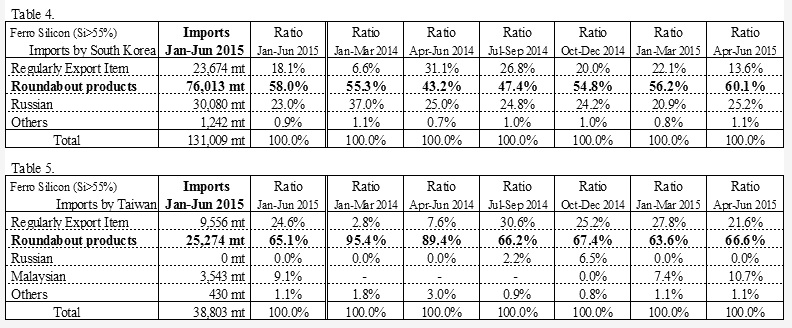

The difference among import volumes of ferro-silicon by respective countries in Asia including Japan and the export volume by China is as shown in Table 1. The share and volume of roundabout products calculated based on the foreign trade statistics of China, Japan, South Korea and Taiwan are as shown in Table 2. For a reference, the imported volumes and shares by main source in Japan, South Korea and Taiwan are as shown in Tables 3, 4 & 5.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:Sophie]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think