Smelters and foundries need support if they are to survive. As a start, Eskom has to sort out its electricity supply problems, and government’s R4-trillion infrastructure plan needs to get under way soon.

Better still, the private sector should be encouraged to provide more traditionally sourced energy.

BHP Billiton has turned off its Bayside aluminium smelter in KwaZulu-Natal. Smelting costs too much, even though the company has a hugely preferential electricity pricing agreement with Eskom.

Bayside, BHP Billiton’s Hillside aluminium smelter and the Mozal smelter near Maputo in Mozambique together used about 9% of South Africa’s total electricity output.

A chunk of state infrastructure funding is being spent on building new energy capacity — mainly the delayed Medupi and Kusile coal-fired power stations, but also the Ingula hydropower project in KwaZulu-Natal.

The manufacturing sector is under pressure from strikes, above-inflation wage and increases in administered price, as well as poor maintenance and development of infrastructure.

Smelters and foundries cannot run without a consistent supply of competitively priced electricity or gas to produce common metals such as aluminium and cast iron. Sasol’s monopoly on gas pricing adds to these competitive woes.

Smelters produce large volumes of molten metals from ores and downstream foundries process scrap metals. These processes make an array of products for industries including aerospace, electrical engineering, transport, containers and packaging and, especially, construction.

Bronze, brass, steel, magnesium and zinc produce castings of different qualities, shapes and sizes. These can be recycled in secondary smelters through remelting scrap metals. But many intermediate costs are involved, including for metals separation.

Alloys are closely associated with the iron and steel industry, which is also the main consumer of ferroalloys — alloys of iron with a high proportion of one or more elements such as manganese, aluminium and silicon.

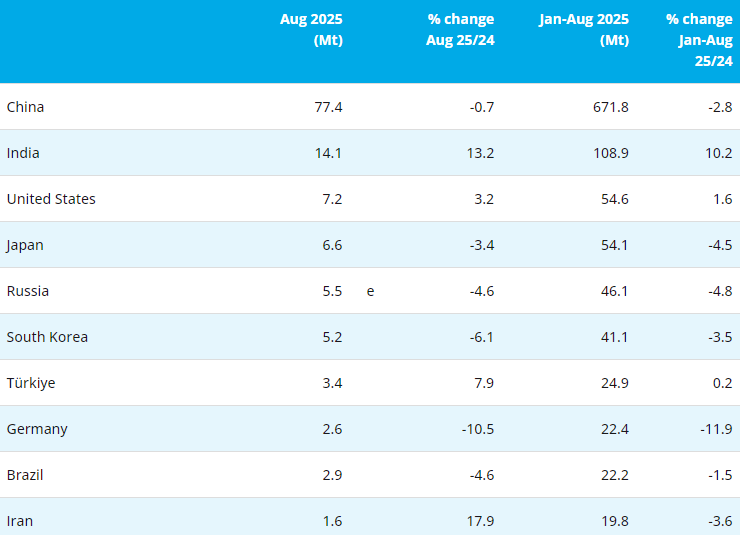

The leading producers of ferroalloys are China, South Africa, Norway, Russia and Ukraine.

Much of the world’s ferrochrome, an alloy of chromium and iron used mainly in stainless steel production, is produced in South Africa, Kazakhstan, India and Turkey.

China’s entry into these markets has hugely altered the global balance. It has replaced South Africa as the top producer and Russia is catching up.

South Africa is the largest exporter of raw chromite ore to China and holds by far the world’s largest reserves. However, its exports of beneficiated ferrochrome to China are rapidly declining as a result of expensive and erratic electricity supply, and other rising costs. This is completely at odds with the government’s industrial growth plans.

China produces half the world’s steel, much of it used in manufacturing cars, industrial machinery and construction. This has pitted South African chrome ore producers — including platinum miners, which produce chrome as a byproduct — against the country’s ferrochrome producers over the export of "cheap" chrome ore.

The government is looking to impose cost-plus production agreements and export tariffs on industrial inputs including "strategic" minerals and scrap metals, to beneficiate raw materials.

Hernic Ferrochrome in the North West, which operates some of the largest ferrochrome furnaces in the world — some of which are shut at times for lack of power — says South Africa’s alloy smelting industry has significantly consolidated and rationalised in recent years.

The ferrochrome industry added new capacity last year, with local and foreign investment in FerroChrome Furnaces near Rustenburg.

"The demand for ferroalloys is still growing in China and stable demand remains from Europe and the US, so the capacity utilisation of available smelters remains high," Hernic Ferrochrome spokesman Samson Mafoane says.

He says all the ferrochrome smelters have arrangements with Eskom to cut back use during peak hours when asked to do so. The "massive tariff increases" for electricity over the past five years caused the industry "to remain marginal", he says.

Some furnaces are used to smelt more competitive alloys but producers are also looking to establish lower-cost operations outside South Africa, in Malaysia and China, he says.

China is commissioning significant ferroalloy capacities that will keep the lid on ferrochrome price rises over the next two years, according to industry analysts.

"This increased capacity requires more raw material, of which South African suppliers will continue to export and share in the additional volumes," Mr Mafoane says, but it raises alloy production costs.

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:sunzhichao]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think